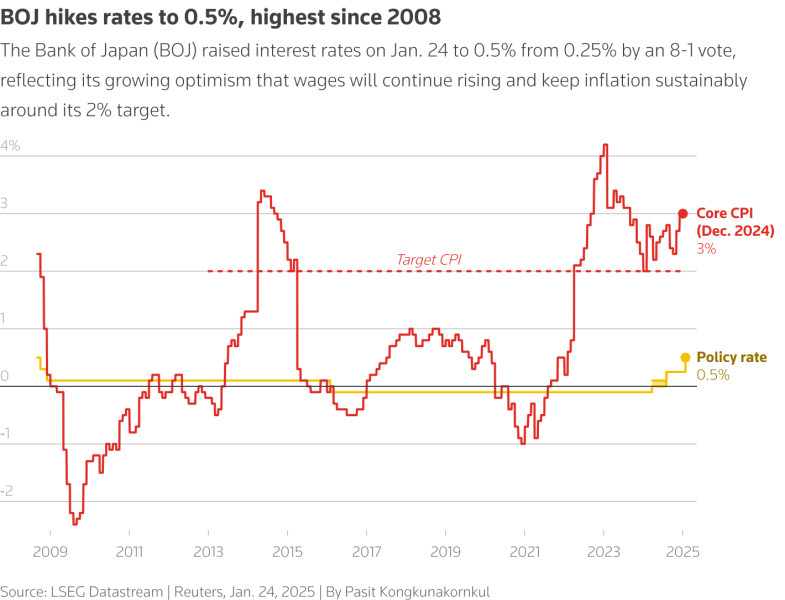

The Bank of Japan (BOJ) has made a significant move by raising its benchmark **interest rates** to 0.75 percent . This decision marks the highest rate in three decades, signaling a major shift in Japan's monetary policy . The rate increase, which came in line with market expectations, is a response to rising inflation and a cost-of-living squeeze that has impacted the Japanese economy .

The BOJ's decision to raise interest rates is part of a broader strategy to normalize its monetary policy after years of unprecedented low rates . This move is expected to have significant implications for both the domestic economy and global financial markets. Higher interest rates typically strengthen the currency, and in Japan's case, this could lead to an appreciation of the **yen** against the **US dollar** as investors seek higher yen-denominated yields .

The BOJ's decision to raise interest rates comes after years of ultra-low rates, which were implemented to stimulate economic growth and combat deflation . The central bank's latest move is a clear indication that it is shifting its focus towards managing inflation, which has been a persistent challenge for the Japanese economy . The rate hike is expected to continue into the next year, with further increases likely as the BOJ seeks to stabilize prices and maintain economic growth .

The impact of the rate hike on the Japanese economy is already being felt. Businesses and consumers are adjusting to the new interest rate environment, which could affect borrowing costs and investment decisions . The BOJ's decision is also likely to influence global markets, as investors reassess their strategies in response to the changing monetary policy landscape .

In conclusion, the Bank of Japan's decision to raise interest rates to a 30-year high is a pivotal moment for the Japanese economy and global financial markets. As the BOJ continues to normalize its monetary policy, the implications for inflation, economic growth, and currency values will be closely watched by investors and policymakers alike . The next steps will involve monitoring how the economy responds to the rate hike and whether further adjustments are necessary to achieve the BOJ's economic goals .