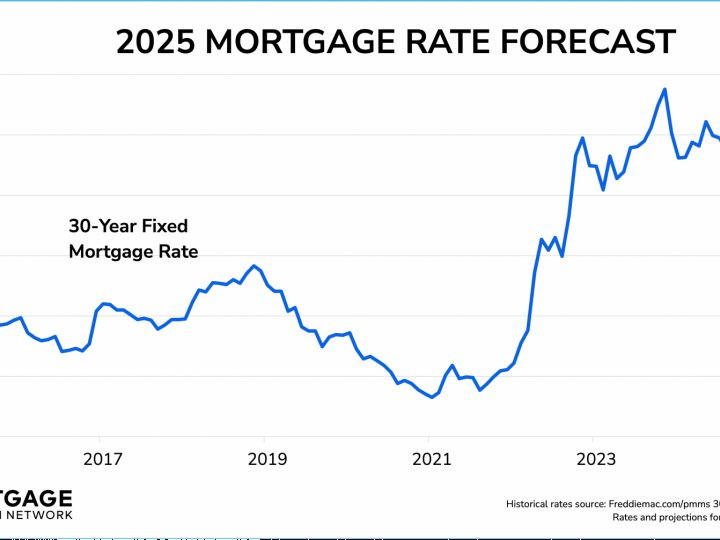

In the ever-changing landscape of mortgage loans, staying informed about current mortgage rates is crucial for both homeowners and prospective buyers. The mortgage refinance rates, in particular, have been a hot topic as of late, with significant fluctuations influencing the decision-making process for many. As of December 10, 2025, a closer look at the trends and factors influencing these rates provides valuable insights for anyone navigating the housing market.

For those looking to refinance, the rates have seen some notable changes. According to the Mortgage Research Center, the 30-year fixed refinance rate has climbed to 6.35%, while the 15-year fixed refinance rate stands at 5.38%. This shift is significant, as refinance rates can greatly impact the overall cost of a mortgage loan. Homeowners considering a refinance should compare these rates with their current mortgage terms to determine if switching makes financial sense.

Another important factor to consider is the variability in rates across different lenders. Bankrate offers a marketplace where homeowners can compare personalized mortgage and refinance rates from various lenders to find the best fit for their financial situation. This comparison is essential, as rates can differ significantly between institutions, affecting the overall savings from a refinance. Similarly, Zillow provides a comprehensive view of current refinance rates, allowing users to see how today's rates could potentially lower their mortgage payments. U.S. Bank also offers updated daily rates for the most common types of home loans, providing a reliable source for the latest information.

The decision to refinance isn't solely about the rate; it's also about the terms and conditions offered by different lenders. Rocket Mortgage, for instance, focuses on personalized rates and flexible terms, such as getting cash out or paying off the mortgage faster. This customization is key for homeowners looking to tailor their refinance to specific financial goals. NerdWallet also provides a detailed comparison of current refinance mortgage rates, helping users find the best deal in their area.

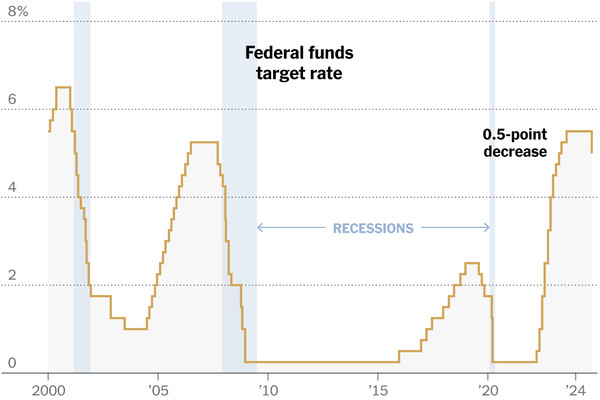

For those considering a refinance, it's important to stay informed about the broader economic context. Mortgage rates are influenced by a variety of factors, including economic conditions and Federal Reserve policies. Keeping an eye on these factors can help homeowners anticipate changes in mortgage refinance rates and make more informed decisions. Overall, while current rates may seem daunting, the potential savings from a well-timed refinance can be substantial, making it a worthwhile consideration for many homeowners in 2025.