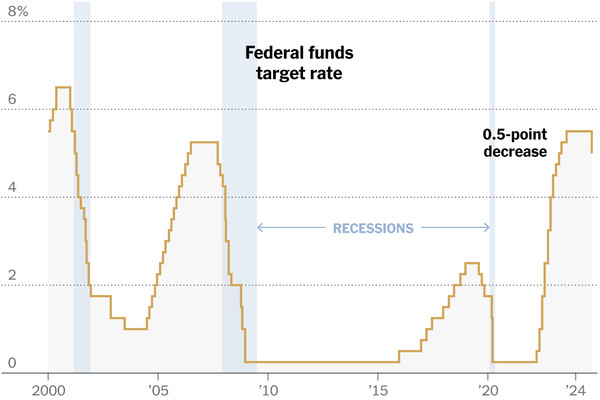

The Federal Reserve has once again made headlines by lowering the federal funds rate by 0.25 percentage points, marking the third consecutive rate cut this year . This decision, announced at the conclusion of the December 2025 meeting, has significant implications for the U.S. economy and the global markets. The rate cut brings the federal funds rate to its lowest level in over three years, stirring both relief and controversy among economists and investors .

The Fed's decision to cut interest rates comes as the U.S. economy faces a delicate balance between employment and inflation. The Federal Reserve is widely expected to cut the federal funds rate by 25 basis points in December 2025, following similar reductions in previous months. This move is aimed at supporting economic growth and stabilizing the job market, which has shown signs of weakness in recent months . The Federal Reserve's benchmark interest rate has been a hot topic of debate, with investors and analysts closely monitoring the Fed's actions and statements. The Federal Reserve's latest move to lower interest rates is part of a broader strategy to support the economy, which has been grappling with high inflation and uncertainty. The Fed's decision to cut rates for a third consecutive meeting was not unanimous, with three members of the policy committee voting against the move. This division highlights the differing views within the Fed regarding the effectiveness of rate cuts in addressing current economic challenges .

Federal Reserve Chair Jerome Powell has been vocal about the Fed's commitment to maintaining economic stability. In a statement following the latest rate cut, Powell emphasized the Fed's dual mandate of promoting maximum employment and stable prices. He noted that while inflation remains a concern, the weakening job market necessitated a cautious approach to monetary policy. This perspective was echoed in the Federal Open Market Committee (FOMC) statement, which outlined the rationale behind the rate cut and the committee's outlook for the coming months .

The Fed also addressed concerns surrounding the inflationary pressures that have persisted despite previous rate cuts. However, the Fed's decision to lower rates reflects a desire to avoid a recession and maintain economic growth. Despite the uncertainty, the latest rate cut was met with a positive response from Wall Street. Investors welcomed the move, which is expected to lower borrowing costs and stimulate economic activity. As we look ahead, the Fed's next meeting, scheduled for early 2026, will be closely watched for further indications of monetary policy direction .

In conclusion, the Federal Reserve's recent decision to lower interest rates for the third time this year underscores the complex challenges facing the U.S. economy. While the rate cut is intended to support economic growth and employment, it also highlights the delicate balance between addressing inflation and maintaining economic stability. As the Federal Reserve continues to navigate these challenges, its decisions will have far-reaching implications for the global economy and financial markets. The coming months will be crucial in determining the effectiveness of the Fed's monetary policy and its impact on the broader economic landscape.