Investors and financial enthusiasts are always on the lookout for the latest news on Netflix stock price and the company's overall net worth. As of 2025, Netflix has rolled out a significant 10-for-1 stock split, which has made waves in the financial markets. This move aims to make shares more accessible to a broader range of investors and employees, especially those participating in stock-option programs, without altering the company’s market capitalization or fundamental business operations.

The historic 10-for-1 stock split took effect on November 17, 2025, leading to a major reset in the trading dynamics of this highly influential tech stock. The split, which was announced several weeks earlier, saw Netflix's shares trading at around $1,100 before the split. Post-split, these shares opened at approximately $110, making them significantly more affordable for retail investors and employees.

This strategic move by Netflix is part of a broader effort to enhance the accessibility of its stock, making it easier for a wider audience to invest in the company. The split does not alter the company's overall value or the total investment returns for existing shareholders, who now own 10 times as many shares but at a tenth of the original price.

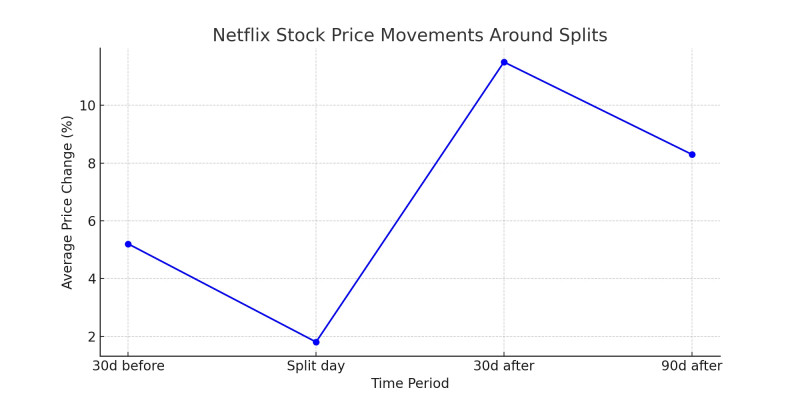

Historically, Netflix has undergone two prior stock splits—a seven-for-one split in 2015 and a two-for-one split in 2004. These splits were similarly aimed at making the stock more accessible and affordable, aligning with the company’s growth and increasing market presence.

The recent stock split is expected to attract more investors, given the lower entry point for shares. This could potentially boost the company's liquidity and trading volumes, which are crucial for maintaining a healthy and vibrant stock market presence. Moreover, the split is likely to enhance the appeal of Netflix's stock to a broader demographic, including employees who benefit from stock-option programs.

As we approach the end of 2025, the impact of this stock split on Netflix's overall performance and investor sentiment remains a key focus. The company continues to navigate the ever-evolving landscape of streaming services, where competition is fierce, and consumer preferences are constantly evolving. Despite these challenges, Netflix's strategic initiatives, like the recent stock split, underscore its commitment to staying a leader in the industry.

Investors are advised to stay informed about the latest developments in Netflix's financial strategy and how it aligns with their investment goals. While the stock split does not change the company's fundamentals, it provides a unique opportunity for both new and existing investors to engage with the stock at a more accessible price point. As the market continues to evolve, keeping a close eye on Netflix's performance and strategic moves will be crucial for making informed investment decisions.