The stock journey of Meta Platforms, Inc. (META) has been a rollercoaster, but recent trends show a surge in stock price. The current stock price is hovering around $661.68, marking a 4.24% increase from the previous close. Investors are closely watching as the stock opens at $675.88, a notable $36.28 increase from the previous day.

Meta Platforms, Inc. has been under significant pressure in recent weeks. Investors are reassessing the stock following a post-earnings reset, largely due to rising artificial intelligence (AI) infrastructure spending. Despite these challenges, the stock has managed to rebound, showing resilience in the face of market volatility.

Analysts have set an average price target of $842.86, which suggests a strong buy consensus. This optimistic outlook aligns with the company's ongoing strategic efforts and innovations, particularly in the metaverse.

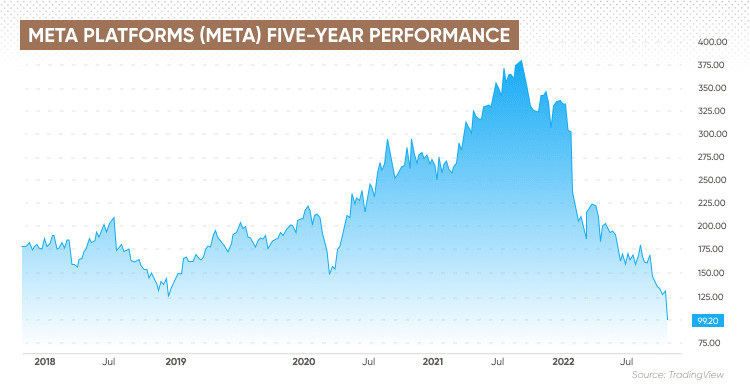

Historically, Meta's stock has seen significant fluctuations. The 52-week high of $796.25 was reached on August 15, 2025, while the 52-week low was recorded earlier in the year. This wide range reflects the stock's dynamic nature and the market's reaction to the company's evolving strategies and performance metrics.

At present, the stock has a market capitalization of approximately $1.68 trillion, with a price-to-earnings ratio of 28.59. While dividends are yielding 32.1%, investors should consider the company's long-term growth potential and its focus on emerging technologies.

For those interested in a more detailed financial overview, Meta's stock history, volume, and performance metrics are readily available. The trading volume on the day in question was 11,134,305 shares, with the stock opening at $644.41 and closing at $639.60. The day’s high was $648.85, and the low was $637.55.

Looking ahead, Meta Platforms, Inc. is poised for continued growth, driven by its innovative approach to social media and its ambitious metaverse initiatives. As the company navigates the challenges of AI infrastructure spending and market volatility, it remains a key player in the tech sector, attracting both short-term traders and long-term investors alike.