GameStop's Q3 2025 earnings report, released on Tuesday, has sparked a mix of reactions from investors. The video game retailer posted earnings per share (EPS) of $0.24, exceeding analysts' consensus estimates of $0.20 by $0.04 . Despite this beat, the company's revenue of $821 million fell short of expectations, marking a 4.6% decrease year-over-year and missing the projected $997.2 million . This discrepancy has left market analysts and investors with a nuanced view of the company's performance.

GameStop's earnings per share for the quarter, though impressive by a narrow margin, indicate that the company is managing its costs effectively. The net margin of 9.41% and a return on equity of 7.72% suggest that the retailer is operating efficiently within its current market constraints . However, the Q3 2025 earnings report also highlights a significant revenue miss, which has caused some concern among investors . The revenue shortfall was evident in the stock's performance, as shares took a nosedive following the report's release .

Analysts had anticipated a different financial outcome, making the revenue miss a notable setback. The $821 million revenue is a notable decline from the previous year, underscoring the challenges GameStop faces in maintaining its market position . Despite the company's efforts to diversify its offerings and adapt to changing consumer behaviors, the revenue shortfall indicates that these strategies have yet to yield the desired results .

Investors will be closely monitoring GameStop's next moves, especially in light of its ambitious initiatives to pivot into the digital realm and expand its e-commerce presence. Despite the current setbacks, the company continues to explore new opportunities, such as digital gaming and blockchain technology, which could potentially drive future growth. The company's strategic shift towards these new areas has been met with mixed reactions, but it offers a glimpse into GameStop's long-term vision and resilience .

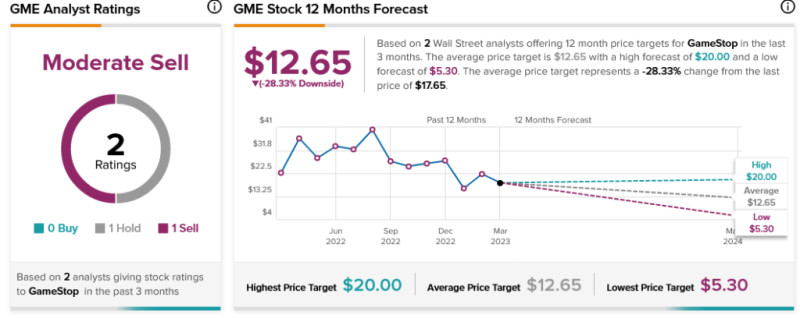

As the market digests the latest financial results, it remains to be seen whether the Earnings per share (EPS) beat will be enough to buoy investor sentiment or if the revenue miss will cast a longer shadow. The meme stock status, which has historically driven significant volatility, adds another layer of complexity to the situation . GameStop's financial performance will continue to be a focal point for investors and analysts alike, as the company navigates the ever-evolving landscape of the video game industry.