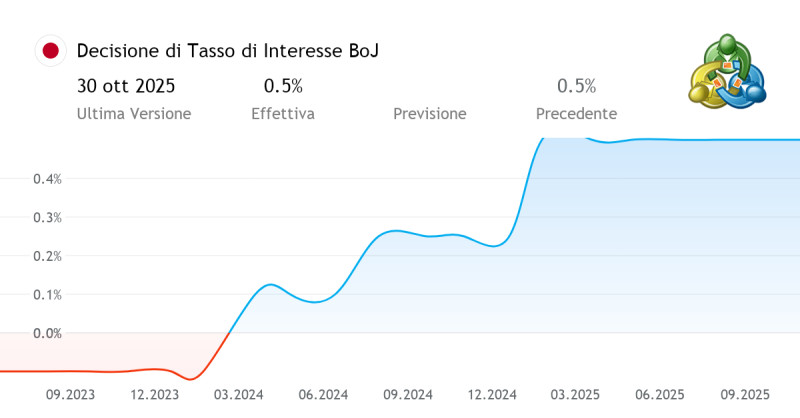

Embarking on a pivotal moment in Japanese monetary policy, the Bank of Japan (BOJ) has raised its key policy rate to 0.75%. This move, the highest rate since September 1995, signifies a major shift away from decades of ultra-loose monetary policy and ultra-low borrowing costs. The decision aligns with global economic trends and is expected to ripple through international markets, particularly affecting the USD/JPY exchange rate.

In an anticipated decision, the BOJ increased its short-term rate by 0.25 percentage points, lifting it to 0.75%. Governor Kazuo Ueda, who will provide further details at a press conference, emphasized the unanimous vote by the central bank. The decision comes after extensive monetary easing and marks a critical juncture in Japan's economic strategy.

Investors are closely watching the move, which is expected to raise the value of the yen against the dollar as investments seek higher yen-denominated yields. This decision signals the BOJ's commitment to "normalizing" its monetary policy with further rate hikes anticipated in the coming year. The increase in rates will also impact the cost of servicing Japan's public debt, which stands as the highest in the developed world.

Financial markets and analysts are engaged in a complex interplay of market speculation and strategic planning. The probability of a rate hike by the BOJ had been pegged at an 86.4% likelihood, with the decision due on Friday. The BOJ’s announcement, slated to be made between 03:30 and 05:00 GMT, will be followed by Governor Kazuo Ueda’s press conference at 06:30 GMT, where he will provide further insights into the central bank’s strategy.

The decision underscores a significant shift in Japan's monetary policy, moving away from ultra-loose measures that have characterized the past three decades. The BOJ’s historic rate hike is a result of careful planning and a broader economic strategy aimed at stabilizing Japan's financial landscape and fostering sustainable growth.